Asset Trade &

Capital Raising

M&A: We provide Transaction Advisory in Indian Renewable Energy Space

M & A

We provide Transaction Advisory in Indian Renewable Energy Space At Sorigin M&A, we leverage our deep domain expertise and storied legacy in the Indian renewable energy sector to offer comprehensive assistance to investors and sellers in the acquisition or divestment of brownfield and greenfield renewable assets tailored to their strategic investment choices across Wind/ Solar/ Hybrid/ Hydro, both in regulatory and C&I markets.

For investors, we provide detailed due diligence and comprehensive asset analysis, ensuring informed decision-making and maximizing potential returns.

For sellers, we optimize their assets to achieve maximum value unlocking, facilitating seamless and successful transactions.

Our Offerings

- Investment / Investor Search and Selection

- Technical Due-diligence and Advisory

- Regulatory and Commercial / PPA analysis

- Buy / Sell Side Advisory

- Asset Transaction Management

- PPA Origination

- Operations and Asset Management

Our team of experts excels at identifying and assessing investment opportunities, ensuring that we present you with carefully curated, investment-ready assets. We understand the importance of your time and strive to significantly reduce transaction and decision-making time by providing you with comprehensive analysis covering financial, legal, technical, regulatory, and commercial aspects.

OUR COMMITMENT YOUR SUCCESS

Post-completion of the transaction, we go a step further by facilitating the seamless Handing Over Taking Over (HOTO) process between the seller and the buyer. Our commitment to your success extends beyond the deal itself.

Our approach is characterized by thorough research, impartiality, and strict confidentiality. We leverage a combination of data analysis, financial expertise, and deep industry knowledge to help you unlock the true value of every opportunity.

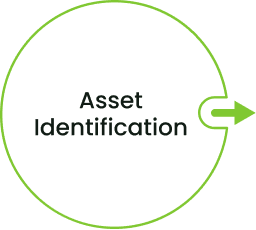

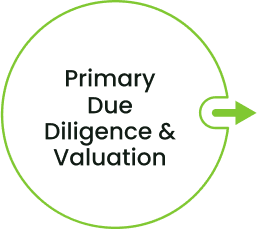

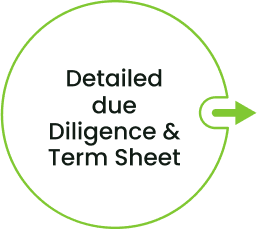

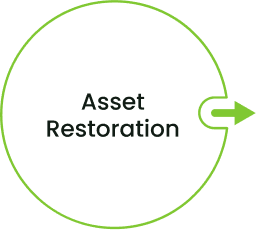

OUR PROCESS

JOURNEY

OUR

STRENGTHS

- Remarkable Group Legacy with 6 GW of Renewable Asset Development, 2.5 GW of Solar EPC, and 10 GW of Renewable Logistics

- Numerous investment opportunities in wind, solar, hybrid, and hydropower, including greenfield and brownfield projects as well as regulated and C&I PPAs

- A strong network of investors and channel partners

- End-to-end project lifecycle support through OMS, Asset Management Services, and Technology Enabled Solutions

- Enable asset improvement and asset restoration for the optimum project output

- Access to current opportunities and listing of active projects

We are trusted by

SELL SIDE

TRANSACTIONS

Sell-Side

- With an integrated approach to performing technical, commercial & financial analysis, we serve as a confidence booster for our customers

- Offering ready access to interested buyers looking at investing in the market

- Providing restoration services and HOTO services for value maximization

Buy-Side

- We maintain long-term relationships with clients and nurture a strong network of investors and channel partners

- Structure the information as required by the investors and lenders for a better pitch

- Offer acquisition financing

- Provide AMS, OMS, and post-acquisition services

We are trusted by

OUR

CLIENTS

FREQUENTLY ASKED

QUESTIONS

For investors, we provide detailed due diligence and comprehensive asset analysis, ensuring informed decision-making and maximizing potential returns. For sellers, we optimize their assets to achieve maximum value unlocking, facilitating seamless and successful transactions.

We offer the following services to our clients:

- Investment / Investor Search and Selection

- Technical Due-diligence and Advisory

- Regulatory and Commercial / PPA analysis

- Refinancing

- Asset Transaction Management

- Operations and Asset Management

We offer comprehensive assistance to investors and sellers in the acquisition or divestment of brownfield and greenfield renewable assets tailored to their strategic investment choices across Wind/ Solar/ Hybrid/ Hydro, both in regulatory and C&I markets.

The number of days it takes to complete a buy or sell transaction in the asset trade business depends on the type of asset being traded. Usually, it takes about 3-4 months for end-to-end transaction execution.

The following table compares the returns in renewable energy to those in other areas:

Particulars | Gold | Fixed Deposit | Corporate Bond | Real Estate | Renewable Energy | Equity | Private Equity |

Returns | 5%-6% | 7%-8% | 8%-10% | 10%-12% | 13%-15% | 14%-16% | 20%-25% |

Growth | Very Low | Very Low | Low | Average | High | High | Very High |

Volatility | Average | Very Low | High | Low | Low | Very High | Very High |

Risk | Low | Low | Very High | Low | Low | Very High | Very High |

Yes, we have clients/investors who are ready to invest in renewable energy based on long term PPAs with clients. However, the investment will depend on the credit rating and financial soundness of the end user.